Macroeconomics 112

I was on Zoom meetings for five hours today. Sorry for posting late.

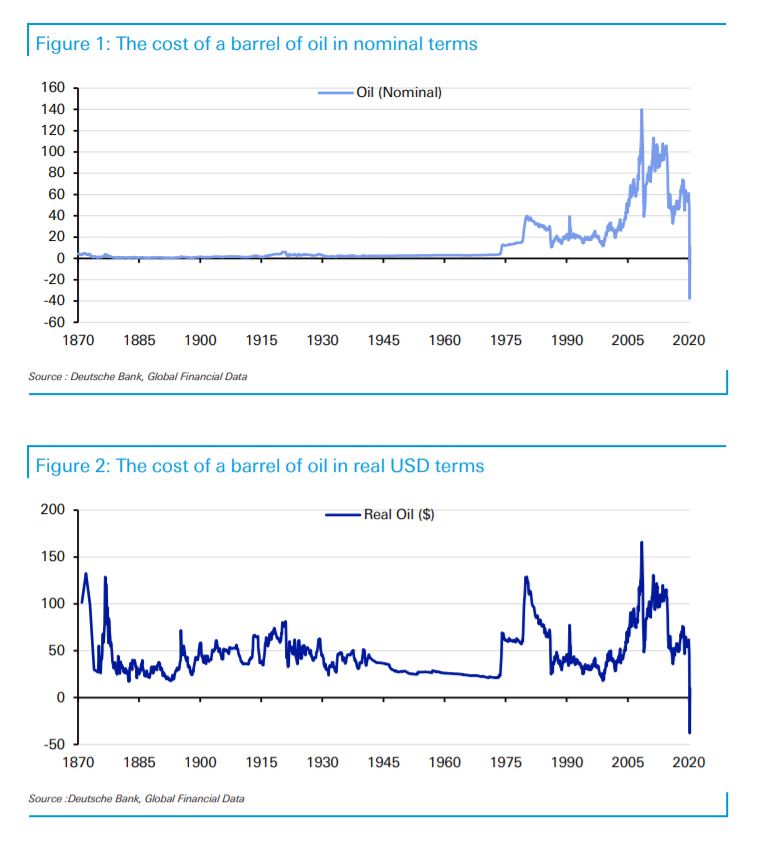

Turns out the negative price for crude oil yesterday was more of a blip than a true catastrophe [update: today may have been more of a catastrophe for U.S. oil], but it was a blip that would have been inconceivable a few weeks ago. If you want my deep dive on why the global crude oil market is on shaky ground, read this

Today is the last day of trading May contracts for the U.S. crude oil “benchmark”, which is West Texas Intermediate (WTI). The concept of a “benchmark” is similar to an “anchor”—it exists to give you a starting point in determining value. If you were traveling in Guatemala and saw something cost 8 quetzales, you would probably refer back to U.S. dollars to understand how much that is, i.e. use the USD as your benchmark.

There are a bunch of crude oil companies in the United States, and the same goes for types of crude oil (4 main categories, 160 sub-categories). Types of oil aren’t exactly like types of wine, because it mostly depends where it is taken out of the ground, but there are some overlaps. For example, WTI is described as both “light” and “sweet”, but I digress.. The point is, WTI is extremely high quality and abundant, which is why it was chosen as the benchmark.

You know how last Tuesday I kind of themed the music recommendation to the post? This week is the opposite. I’m going to recommend refined Sufjan Stevens while blogging about crude oil.

Sufjan is untouchable. If you don’t like him, we can’t be friends. He’s from the Midwest, like me, and he originally garnered media attention by claiming he was going to write an album for each of the 50 states. He only wrote two, but the two were where I grew up and where I went to college, so that was good enough for me! He’s a genius.

For those of you who think you’re woke and socially conscious/conscientious because you have feelings about the Flint water crisis, consider this: Sufjan wrote/arranged/recorded a song entitled “Flint (For the Unemployed and Underpaid)” in 2003. 2003! I would say get on his level, but you can’t.

Since the first of June

Lost my job

And lost my room

I pretend to try

Even if I tried alone

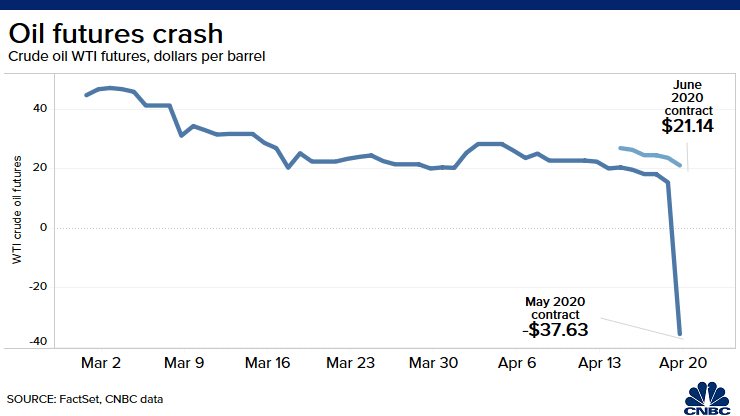

Crude oil contracts trade by the month, and for the month of May, the owners of the contracts who tried to sell yesterday found they didn’t have any buyers. Prices plummeted from about $19 per barrel, to $5, to $0, below $0, all the way down to -$37.63! The markets closed at $5 per barrel.

It was the first time oil prices had ever gone below zero, and a negative price means what it sounds like: owners of the contracts (which could be the companies, or investors/speculators) were briefly paying buyers to buy crude oil (to be delivered in May). This happened because it’s starting to look like our nationwide crude oil reservoirs will be full by May, so storing more will require buyers to obtain additional containers somehow, either by building it or transporting the oil somewhere else, and those things have costs.

All of this reminds me of the rolls of astroturf we’ve had sitting in a field behind our school for years. Here is the story: a representative from a big public school reached out to us and asked if we wanted astroturf, at no cost. The story was they were renovating their field and were looking to donate the old turf. We had to let them know by the end of the day, but there was no way we could gather all the information necessary to know whether we could use it before then. In ongoing talks, they offered to donate it AND give us a check for several thousand dollars. Ultimately, we said sure, we have room to store it and they are paying us to take it, so why not.

As the semi-trucks paraded across campus all day, unloading 80,000 square feet of used astroturf, our lesson in turf economics began. Turns out, since there is so much rubber involved, you have to pay hefty fees to throw astroturf away. This other school had to pay for the semi-trucks either way, to get it off their campus, and paying us to take it was far cheaper for them than paying to trash it. Once it was determined we wouldn’t be able to use it on our field, it became clear the costs of getting rid of it would be far greater than what we were paid to take it. The end.

I should have known better*

Nothing can be changed

The past is still the past

*Note: I’m poking fun at myself here for my involvement in the astroturf mishap, but Sufjan is talking about memories with his recently deceased mother. These things are not the same; Carrie & Lowell is the most emotionally devastating album I’ve ever listened to, and is not to be trifled with. It has my highest recommendation possible. #embracefeelingfeelings

The astroturf is not a perfect analogy, but it does help explain how situations arise where prices can be negative. Even if you do have a place to store a few hundred thousand barrels of crude oil, you’re probably going to be apprehensive about buying because you’re not certain you will be able to sell it anytime soon, and there are costs of storing it.

That being said, it’s still pretty wild to imagine someone paying you $37 to fill up your 20-gallon tank of gas (one barrel of WTI produces ~20 gallons of gasoline).

Today, the crude oil insanity continued, as the June 2020 contracts plummeted from over $20 to $11.57 per barrel. It seems like the market is in full flight mode, as the exchange had to shut down trading multiple times and people are panic-selling things that are only tangentially related to the current price of oil. Irrational? I don’t know, is it irrational to buy stock in “ZOOM” right now? That company, Zoom Technologies, Inc., has nothing to do with Zoom video calls (ZM), but ZOOM stock value zoomed up 900% in 2020, until finally the Securities and Exchange Commission suspended its shares. You still can’t prove it’s irrational though, what if I was intentionally buying the wrong stock because I assumed many others would be buying accidentally? In the same way, what if I’m not panicked about crude oil prices, but I am afraid other people will panic? Either way, I want out.

So, the question is, what happens next?

First, President Trump attempted to slow down the crashing crude oil market by stating he plans to purchase 75 million barrels of oil to add to the Strategic Petroleum Reserve. This was a middle step, it’s not quite giving federal money away to U.S. oil companies to keep them afloat, but the government doesn’t really have any need to add to the reserves right now, either. Imagine you’re a kid with a lemonade stand and no one is buying your lemonade, then your dad comes out and buys half a gallon and puts it in the fridge. You can see how that would work, right? If you’re the buyer in the earlier example who isn’t sure if you will have anyone to sell your oil to once you buy it, Trump is saying, “hey, relax, the government will take it off your hands in the near future. Go ahead and buy, it’s a good deal.” If people were reassured, it may have increased demand and stabilized the crashing prices. That middle step wasn’t enough, though, because the markets continued to drop.

Let’s talk about subsidies.

A subsidy is a form of economic aid or support extended to a sector of the economy, you can think of it as a “reverse tax”. The basic idea is that a subsidy is intended to reduce the cost of doing business, for the recipient. Government subsidies are intended to promote public goods, and be in the general public interest. There are lots of examples (which makes free market advocates wince, since every subsidy is also an intervention in the economy), but here we are.

Believe it or not, oil is a great example! It is more expensive to produce crude oil in the United States than it is in many countries abroad, due to the type and location of our oil reserves. If U.S. companies paid $50 per barrel to produce oil, but U.S. buyers could get as much oil from Saudi Arabia as they wanted for $18 per barrel, then U.S. oil sellers couldn’t compete and wouldn’t survive. So, the U.S. government subsidizes the oil industry, meaning they put a giant thumb on the scale. Oh, you can’t compete with international prices? Let’s make it easier for you. One example is the 1995 Deep Water Royalty Relief Act, where the government said they wouldn’t charge U.S. oil companies who wanted to drill on federal land. It’s like letting your kid live in your basement free of charge—it helps him “get on his feet”, and doesn’t cost you anything extra (the cost to taxpayers is in foregone revenue, i.e. uncollected taxes from those oil corporations; ~$50,000,000,000?). And you can see the argument for why the government would want to prop up a domestic oil industry, right? It’s related to national defense and being self-sufficient, which is a fairly direct argument to be in the public good. If your country is the equivalent of a castle, you’re going to want food, water, energy supplies within the walls, just in case.

Those oil subsidies have been effective, meaning that many technological advancements have been made over the past few decades, bringing down the cost of producing crude oil and making U.S. producers more competitive internationally. For a stretch recently, we were the top international producer (in a cartel-bargained arrangement, remember). In the ideal subsidy scenario, we could take the training wheels off the oil industry, but clearly the situation has changed.

More Sufjan wisdom—not sad, just matter-of-fact:

All the glory that the Lord has made

And the complications you could do without

So, the next step for President Trump and our federal government is likely straight up giving U.S. oil companies money. Paying U.S. oil companies not to produce oil is in the cards.

If that sounds like a bad plan, then you aren’t going to like hearing we’ve been doing this exact thing with farmers, dating back to The Great Depression. The total amount paid to U.S. farmers in 2019 was about $19,000,000,000 (19B), which was exceptionally high due to the ongoing trade war with China, and resulting retaliatory tariffs. The money went toward things ranging from paying farmers to keep fields idle, to buying excess crops, to making up the difference if crops were selling below the cost of production.

Quick note on tariffs. Tariffs are taxes on imported goods, and they exist for the same reason as subsidies but work the opposite way. In the earlier example, if the government wanted to, they could have put a $32 tariff per barrel on imported Saudi Arabian oil, to level the playing field. If you want to buy Saudi Arabian oil, you pay $18 to the Saudi Arabian company, and a $32 tax to the U.S. government. If you want to buy U.S. oil, you pay $50 to the U.S. company. It’s $50 to you either way! So, tariffs and subsidies are tools that are used in different scenarios to achieve similar outcomes. I will have a separate post on tariffs, just wanted to make the connection while it was there.

Are subsidies good or bad? Instead of saying “it depends”, I’m going with “Who’s to say?” [The all-time best response to someone asking if a dead dog was a good dog]

There are tradeoffs involved, of course, and your opinion on this is determined by what you consider the full costs and benefits to be, and what you value. Subsidies are something citizens need to pay attention to, because, just like anything else the government pays for, it’s funded by taxpayers. Do we want to dramatically increase subsidies for U.S. oil? Well, what is the alternative? It’s a difficult question to answer.

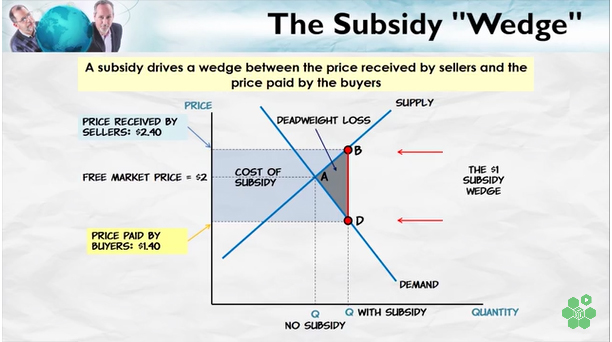

In this example, the government is paying a $1.00 subsidy. Free market price, without government intervention, is at $2.00. The effect of the subsidy is to substantially lower the price paid by the buyers ($1.40), and increase the money received by the sellers ($2.40).

Beyond the literal taxpayer-funded cost of each subsidy, which is the light blue area on this graph, every subsidy will also create “deadweight loss”. The basic idea is that, at the artificially low price, buyers will purchase more oil than they *should*, according to the free market, and producers will produce more oil than they *should* at the artificially high price of $2.40. That leads to other consequences, which becomes impossible to track pretty quickly. But, here we are, today, with the fundamental problem of U.S. taxpayers financing U.S. oil companies to produce more oil than they should, and the likely solution being for U.S. taxpayers to pay U.S. oil companies to not produce oil. Oof. Is there a better option at this point? Not that I can see.

Meanwhile, there are currently more than 40,000,000 (40M) barrels of Saudi Arabian oil en route to the United States. Don’t be surprised if we pass a ban on oil imports soon.

If you want an example of a subsidy that is pretty clearly wasteful and corrupt and should be ended, take a look at the U.S. sugar industry. Yikes.